We maintained our investment grade rating, which was ratified by the main risk rating agencies: moody's and fitch.

Our first challenge for 2020 was to achieve the budgeted income, taking into account the start-up of Cusiana Phase IV project. However, the COVID situation led to a significant drop in gas demand, affecting our revenues and financial results.

As of the issuance of CREG Resolution 042, we implemented a transitory Commercial Policy between April and September 2020. It allowed a temporary change in the pair of charges for the affected transport capacity (CTA), which, on average, was 12.7% of the firm contracted capacity, thus generating an affectation of USD 22.2 MM in the income of our company.

We achieved the entry into operation, in January 2020, of the Puerto Romero-Vasconia (Cusiana Phase IV) loop, which contributed 46 MPCD and revenues of approximately USD 26.6 MM.

We closed the year with operating income of USD 455.8 MM. This is a decrease of 2.8% compared to 2019 and a budget compliance of 92.4%.

Our second challenge was to maintain operational efficiency from the incidence of costs and expenses, which gained relevance with the drop in income. Costs and expenses were USD 104.2 MM, which represents a variation of -3.8% compared to 2019 and -11.6% compared to the 2020 budget, estimated at USD 118 MM.

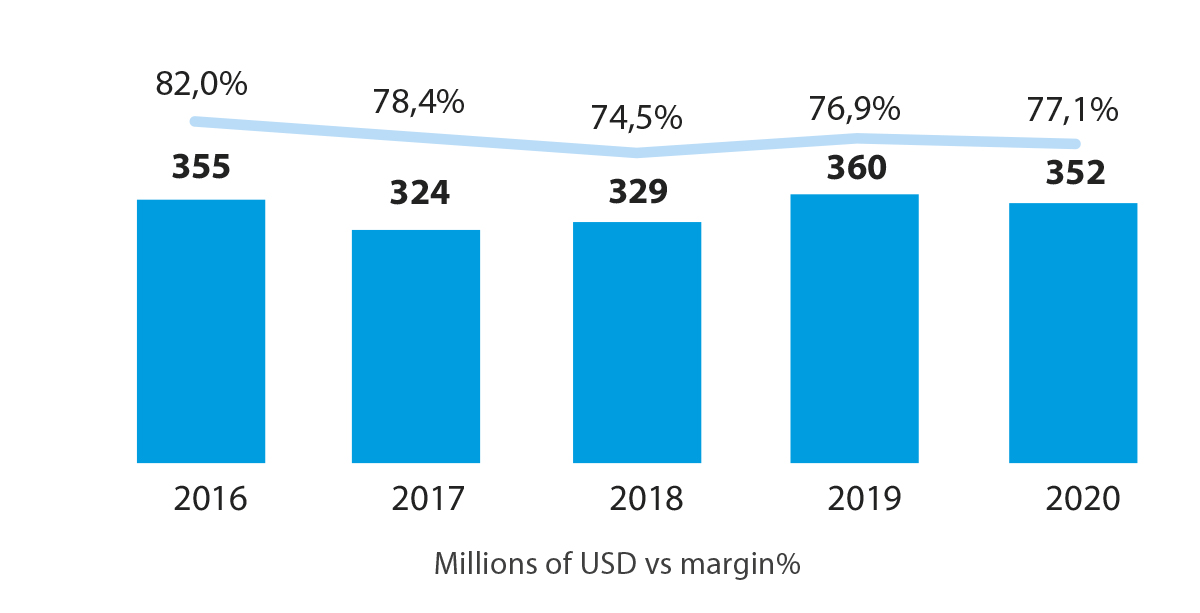

We obtained an Ebitda of USD 351.5 MM, 2.5% lower than the 2019 Ebitda and 6.4% compared to the budget. This reduction led to a slight increase in our leverage level, measured through the gross debt / Ebitda indicator from 3.15 times at the end of 2019 to 3.21 times at the end of 2020. Similarly, our interest coverage went from 5.15 times in 2019 to 5.00 times in 2020.

Ebitda evolution and Ebitda margin

Click on the image to enlarge.

We continue to support the structuring of strategic projects that guarantee new income, either through UPME decisions or at our own risk. In 2020, the UPME published the Supply Plan, including the projects in which TGI acts as the incumbent transporter (for example, Yumbo-Mariquita bidirectionality) and the affirmation of the Pacific Gas Import Infrastructure. Regarding the latter, the UPME published the investor selection documents (DSI) and we worked on the study of the specifications, the identification of risks and the analysis of the bankability of the project.

We created the group called Efficiency Pillar, led by the Financial, Operations and Strategic Planning areas; we meet every week to encourage other areas to bring sustainable savings initiatives as they monitor progress.

We work across the board to identify cost and expense savings initiatives in all areas of the company to establish a Pillar of Efficiency. However, we did not manage to structure in detail the operational efficiencies and a plan to achieve the required savings in view of the new business reality in 2021.

In addition, we were able to deliver dividends to our shareholders of nearly USD 94.6 million.

We support the management of the revenue impacts by Covid-19 through the development of projection scenarios, which served as a tool in the decision-making process of Senior Management. This made it possible to identify risks, define the transitory Commercial Policy and obtain authorizations to contract short-term debt in order to ensure liquidity.

At tgi, we have the challenge of implementing the strategy for generating new businesses and income to continue growing and providing development to colombia.

In the short term (2 years):

Capture the OPEX savings incorporated into the goals for the year through the initiatives identified in the Efficiency Pillar.

Maintain high focus on generating higher income leveraged in new ventures.

Continue with the commitment to advance in the project of the Pacific Regasifier included in the Supply Plan of the UPME.

Continue to manage the potential regulatory impacts with the Government and authorities, including the risk that Resolution 160, issued at the end of 2020, may generate, which could significantly impact the profitability of the gas transportation business.

In the long term (between 2 and 5 years):

Implement the strategy defined in 2020, which includes investment and generation of new business or income for the company, in order to continue growing and providing development to the country.

Be attentive to possible businesses outside of Colombia, for which our challenge is not only being gas transporters, but also the opportunities that may be sought within the midstream, in order to diversify the business portfolio.